LATEST NEWS

Take advantage of our wide array of digital banking products and services

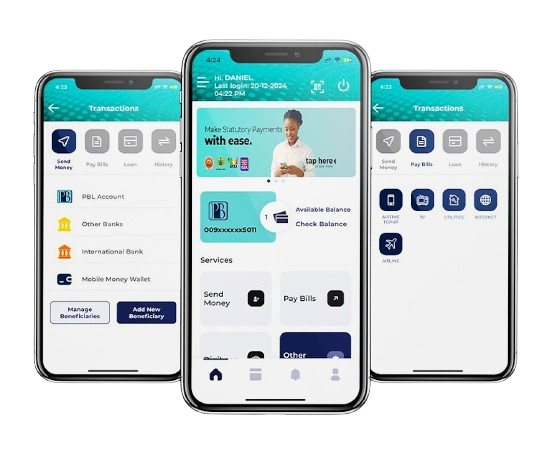

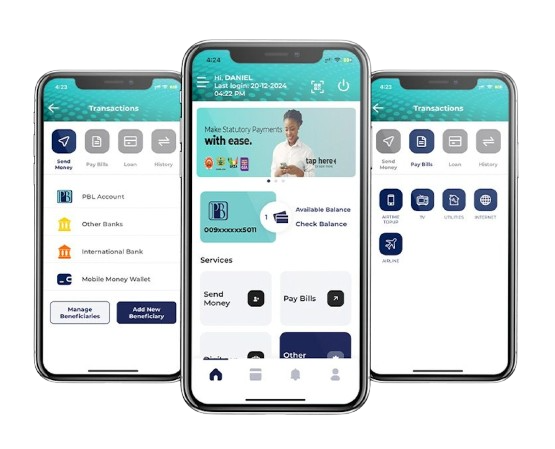

The PBL Mobile App brings a host of convenient features designed to make managing your finances easier than ever.

Read more

Manage your PBL account 24/7 with netWise. Fast, secure, and real-time online banking from any device.

Read more

Pay bills, send money, manage your cards, and so much more, all from your smart device.

You will need the following documents:

A valid national ID (GHANA CARD)

One recent passport sized photograph.

Current GPS address if there is a change of residence

A contact number if there is a change

Any other relevant information required.

You can update your account information by:

Yes, you can access your account anywhere in the world using the Prudential Bank netWise internet banking service, the PBL Mobile App, or our mobiWise mobile banking service if you are on roaming with your local mobile number.

Check out our financial literacy content designed to kickstart your journey to financial freedom